Farmers Lender of Kansas City is often a very regarded lender featuring competitive costs on home loans in nearly every point out. And you will full your complete mortgage approach on line.

Mainly because nonjudicial foreclosure (exterior the court system) is less expensive and more quickly than judicial foreclosure, lenders in states in which it is accessible can demand decrease desire premiums.

While mortgage refinance costs have absent up, several Florida homeowners have considerably more tappable equity now due to soaring residence values recently.

“Qualified confirmed” implies that our Monetary Evaluation Board carefully evaluated the post for precision and clarity. The Critique Board comprises a panel of monetary professionals whose aim is to make certain our content material is always objective and balanced.

The fees and every month payments demonstrated are dependant on a personal loan quantity of $940,000 as well as a down payment of at the very least 25%. Find out more regarding how these fees, APRs and every month payments are calculated. Furthermore, see a jumbo estimated month-to-month payment and APR instance. Get additional facts.

The program offers a second mortgage that can be applied possibly as being a down payment help or closing Expense guidance, wherever suitable borrowers can attain a three%, four%, or 5% of the purchase cost of their dwelling beneath the HFA Most popular Grants Florida plan to first-time customers.

What is the difference between a set and adjustable price mortgage? In the situation of a hard and fast-price mortgage, the speed is continuous for the entire length of your mortgage. On the other hand, an adjustable-rate mortgage or ARM is dependent that you can buy forces. Exactly what are the mortgage prices in Florida? Mortgage costs in Florida are the curiosity lenders charge for refinancing or property financial loans. These mortgage fees straight influence the whole borrowing expenditures in Florida. Exactly what are The existing mortgage fees delayed financing interest rates in Florida? The existing mortgage charges in Florida for various personal loan products and solutions could be seen within the desk above. The premiums are up-to-date twice every day to ensure that our shoppers and site visitors to our site usually have accurate estimates of daily’s mortgage fees. Learn More Florida First-time Homebuyer Plans

Nevertheless, the financial institution doesn’t offer you Digital notarization or closing products and services, which decreased its rating a little bit.

Florida homebuyers can get help with down payments and shutting expenses and tax credits with these programs. Most courses need a least credit rating score of 640. You have to work with an approved taking part lender. Your own home acquire value and earnings can't exceed boundaries, which fluctuate by county.

These commonly feature a necessity for a larger deposit — not less than ten % of the acquisition rate — and the next credit rating score.

Property values are continuously altering based on purchaser demand and also the community market. Generally, home values enhance eventually. Get in touch with a Florida lender to learn more about regional requirements for mortgages.

APR 1 The annual share rate (APR) signifies the legitimate annually Charge of your respective financial loan, which include any expenses or expenditures Besides the actual interest you pay back into the lender. The APR can be greater or lowered after the closing day for adjustable-charge mortgages (ARM) financial loans.

We also reference unique investigate from other trustworthy publishers the place correct. You can learn more regarding the criteria we abide by in producing accurate, impartial written content inside our

Advertiser Disclosure We're an unbiased, marketing-supported comparison company. Our purpose is to assist you make smarter financial choices by furnishing you with interactive equipment and economical calculators, publishing unique and goal content, by enabling you to carry out investigate and Examine facts at no cost - to be able to make money conclusions with self-confidence.

Jaleel White Then & Now!

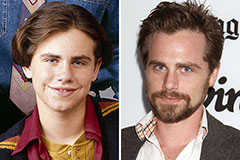

Jaleel White Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Joseph Mazzello Then & Now!

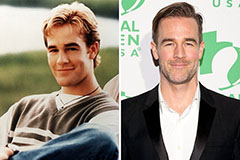

Joseph Mazzello Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now!